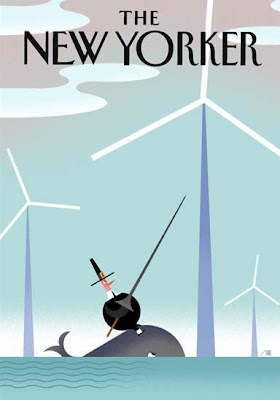

“This project is all about our clean energy future"

After ten years of a seemingly never-ending permitting process, one gets a little nervous about saying that anything about the historic Cape Wind project (the first offshore wind farm proposed in the U.S.) is absolutely final. But yesterday's decision by the Massachusetts Department of Public Utilities' approval of the contract between Cape Wind and National Grid is pretty close.

After ten years of a seemingly never-ending permitting process, one gets a little nervous about saying that anything about the historic Cape Wind project (the first offshore wind farm proposed in the U.S.) is absolutely final. But yesterday's decision by the Massachusetts Department of Public Utilities' approval of the contract between Cape Wind and National Grid is pretty close.Massachusetts Governor Deval Patrick is right on the mark when he says this is all about our clean energy future. (GW)

National Grid can purchase output

Boston Globe

November 23, 2010

The state Department of Public Utilities gave permission yesterday for National Grid to purchase half of Cape Wind’s power, removing the last significant hurdle for construction to begin on the controversial wind farm in Nantucket Sound next year.

The agency, however, refused to approve a second agreement for the sale of the project’s remaining power. Without a buyer for that energy, Cape Wind could have trouble arranging financing for the proposed 130-turbine project, energy specialists said, with some suggesting only half of the turbines may now be built.

“The power from this contract is expensive in light of today’s energy prices,’’ the 374-page DPU decision says. “It may also be expensive in light of forecasted energy prices, although less so than its critics suggest. . . . However, it is abundantly clear that the Cape Wind facility offers significant benefits that are not currently available from any other renewable resource.’’

Among those benefits, the administration has long said, are cleaner air, reduced reliance on fossil fuels, energy security, and a more diverse mix of power sources.

While Cape Wind is expected to cost National Grid residential customers less than $2 a month, because it will account for a small percentage of the utility’s power supply, the cost of Cape Wind’s electricity will be double the current cost of power generated from fossil fuels. That higher price erupted into a major controversy in recent months, including during the gubernatorial race, amid a struggling economy and in a state with some of the nation’s highest electricity costs. The Cape Wind project is expected to cost more than $2 billion.

“This project is all about our clean energy future, and today that future is closer than ever,’’ Governor Deval Patrick, a champion of the project, said in a statement yesterday.

Opponents said they would appeal the decision to the state Supreme Judicial Court.

“We are disappointed in the DPU’s decision,’’ said Robert Rio, senior vice president of Associated Industries of Massachusetts. “National Grid ratepayers will be on the hook for billions of dollars in unnecessary rate increases.’’

The project, which Cape Wind says could produce the equivalent of three-quarters of the electric needs of the Cape and Islands, has undergone years of environmental review and political maneuvering, overcoming opposition from the late Senator Edward M. Kennedy, whose Hyannisport home overlooks Nantucket Sound.

While opponents’ early concerns were centered on aesthetics — the turbines would be visible low on the horizon from the Cape and Martha’s Vineyard and Nantucket — the battle was fought by raising other issues, including possible effects on property values and harm to birds, fishing, aviation, and historic and cultural sites.

Under the agreement with National Grid, residential customers’ bills would increase by roughly 1.3 to 1.7 percent, with businesses’ bills increasing roughly 1.7 to 2.2 percent. Overall, the commission said the cost to consumers above market prices during the length of the contract would most likely be between $420 million to $695 million.

But that is if the entire project gets built and if it receives the bulk of the federal incentive money it is hoping to get. Last week, Cape Wind acknowledged it would not meet the deadline for the most lucrative federal incentive, an up to 30 percent cash grant that could have been worth hundreds of millions of dollars.

The deadline for that grant, which required construction to begin by the end of this year, will be missed, Cape Wind officials said, because two permits — one from the US Environmental Protection Agency for air pollution during construction, and the other from the US Army Corps of Engineers for placing a structure in navigable waters — are not in hand yet.

An EPA spokesman said its permit is expected in the next month; an Army Corps official said its decision could come as soon as next month but more likely will not come until next year.

While the project is still eligible for significant other incentive funding, most would be based on the number of turbines installed by the end of 2012. If fewer turbines are built, the price of each unit of electricity generated will increase, but is capped at 19.3 cents per kilowatt hour, according to an agreement the Massachusetts attorney general’s office struck with Cape Wind. That agreement also creates ways consumers could save money if the cost of Cape Wind is less than anticipated.

In its decision, the DPU also laid out its reasoning for denying the second contract, which would have allowed National Grid to assign the remaining portion of Cape Wind’s power to another buyer under the same financial terms.

The DPU officials said there was “no clear purpose’’ for such an approval, saying that if Cape Wind wants to enter into another contract with a buyer, it should follow normal rules and go before the commission.

Some energy specialists said that denial, coupled with the loss of the most lucrative financial incentive, could mean big changes for the project.

“Everytime they get one of these halfway results, it reduces their ability to finance,’’ said Robert McCullough, an Oregon-based energy consultant who is not involved in the Cape Wind project but worked for opponents of a proposed wind farm off Block Island.

Cape Wind disputed that assertion, releasing a statement saying, “We are pursuing multiple options for selling more power.’’

Sue Reid — a lawyer with the Conservation Law Foundation, an advocacy group in favor of the wind farm — said she expected the full project to be built. She said the DPU’s refusal of the second agreement was unimportant.

“Why would anyone come in until they know what the regulators will do with the first contract?’’ she asked. “I am convinced that Cape Wind will sign a contract for the other half’’ of its power.

Beth Daley can be reached at bdaley@globe.com. ![]()

0 Comments:

Post a Comment

<< Home